Why Choose LCO?

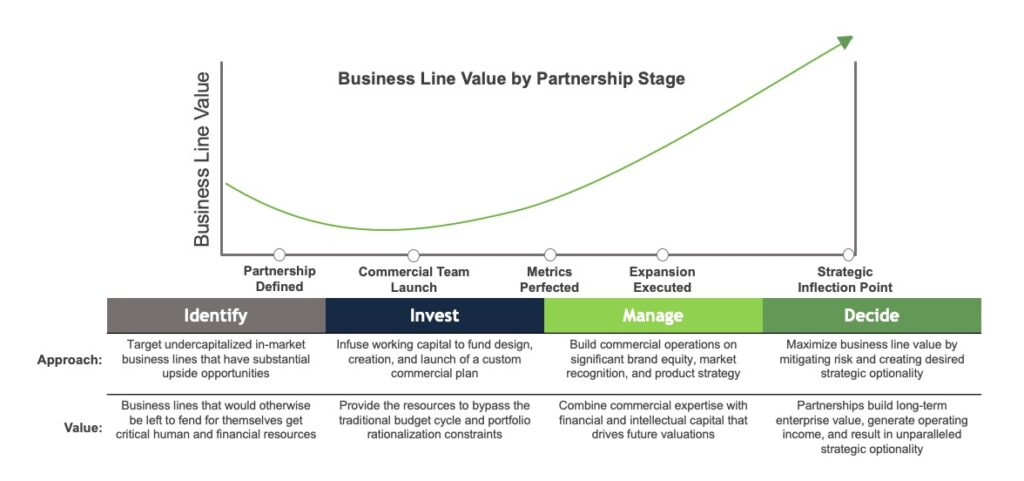

Partnering with LCO Capital allows healthcare manufacturers to extract the maximum value out of their various product lines. Our Value Creation Mechanism infuses underperforming or undercapitalized product lines with the resources they need to reach their true potential and creates strategic optionality for the management teams to make the right investment decision with the data to back it up.

An LCO℠ is a business model that allows for financing of a third-party commercial team, outside of the current budget cycle. If you have a business unit, product line, or recent acquisition that could benefit from additional resources for commercial growth, reach out today.

Conserving Resources

Companies are forced to be more strategic than ever with their capital due to the combined effects of the current pandemic and the trailing impacts of recent mega-mergers. An LCO provides the resources to grow a product line and justify an improved budget while minimizing the resources and risks necessary to achieve your growth goals.

Driving Growth

Our team of industry experts have over a decade of experience working together revitalizing product lines and managing commercial operations. De-risk your expansion plans by partnering with the experts and access our human and intellectual capital to optimize your growth plans.

Our Unique Model Provides Resources to Grow Now and Decide Later

LCO Capital identifies an undercapitalized in-market business line that has substantial upside, and invests in a laser-focused commercial team to drive growth and market share for that business line through SalesForce4Hire, our value-additive partner. Leveraging SalesForce4Hire’s proven ability to design, launch, and scale commercial teams to grow the value of LCO Capital’s investment, we return control of the commercial team to the partner organization once the Value Creation Mechanism has run its course and receive a share of the value created. The investors access the significant returns, while the corporate partners utilize the value created in the business line to justify further internal investment or divestiture.