Our Value

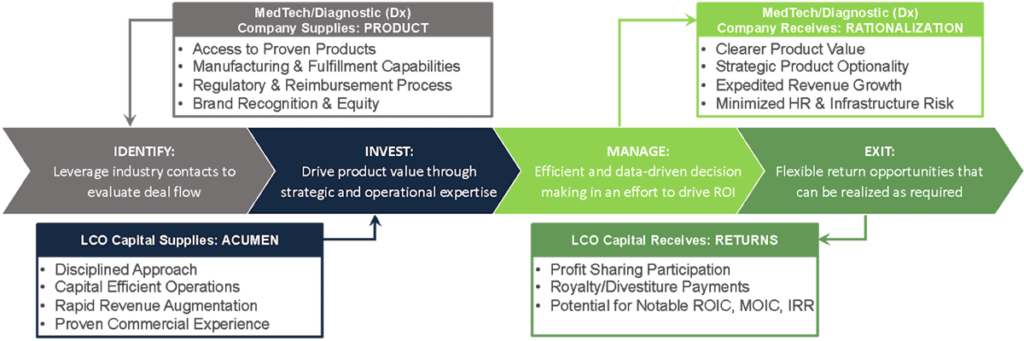

We provide underperforming business lines with value-add financial and intellectual capital focused on the commercial activities to grow and validate the business line.

An LCO℠ is a business model that allows for financing of a third-party commercial team, without the acquisition or divestiture of an owned business line. The resulting revenue generated is split between the commercial team, the investors, and the partner company.

How It Works

The McGeever Family Office acts a strategic partner that engages in fee-for-service and/or risk-sharing relationships to drive success via an LCO℠. We work collaboratively with management teams and senior executives to revitalize businesses to prepare for expansion or acquisition. Our combination of deep commercial expertise and financial and intellectual capital accelerates commercial success through our Value Creation Mechanism.

Who Do We Partner With?

Potential partners are those looking to address financial, strategic, or operational needs to maintain market leadership, accelerate growth, and improve profitability. Investors who are looking to diversify their portfolio and access blue chip companies without the costs of a traditional acquisition benefit from the Value Creation Mechanism through the significant returns it seeks to generate.